It is well known that Taiwan Semiconductor Manufacturing Co. and Samsung Foundry dominate the market of contract chip production. They are the only companies to offer leading-edge process technologies and have the largest capacities. Meanwhile, TSMC and Samsung Foundry are on track to become the dominant manufacturers of advanced chips as nobody, including Intel, can match their capital expenditures.

TSMC: Big Can Only Get Bigger

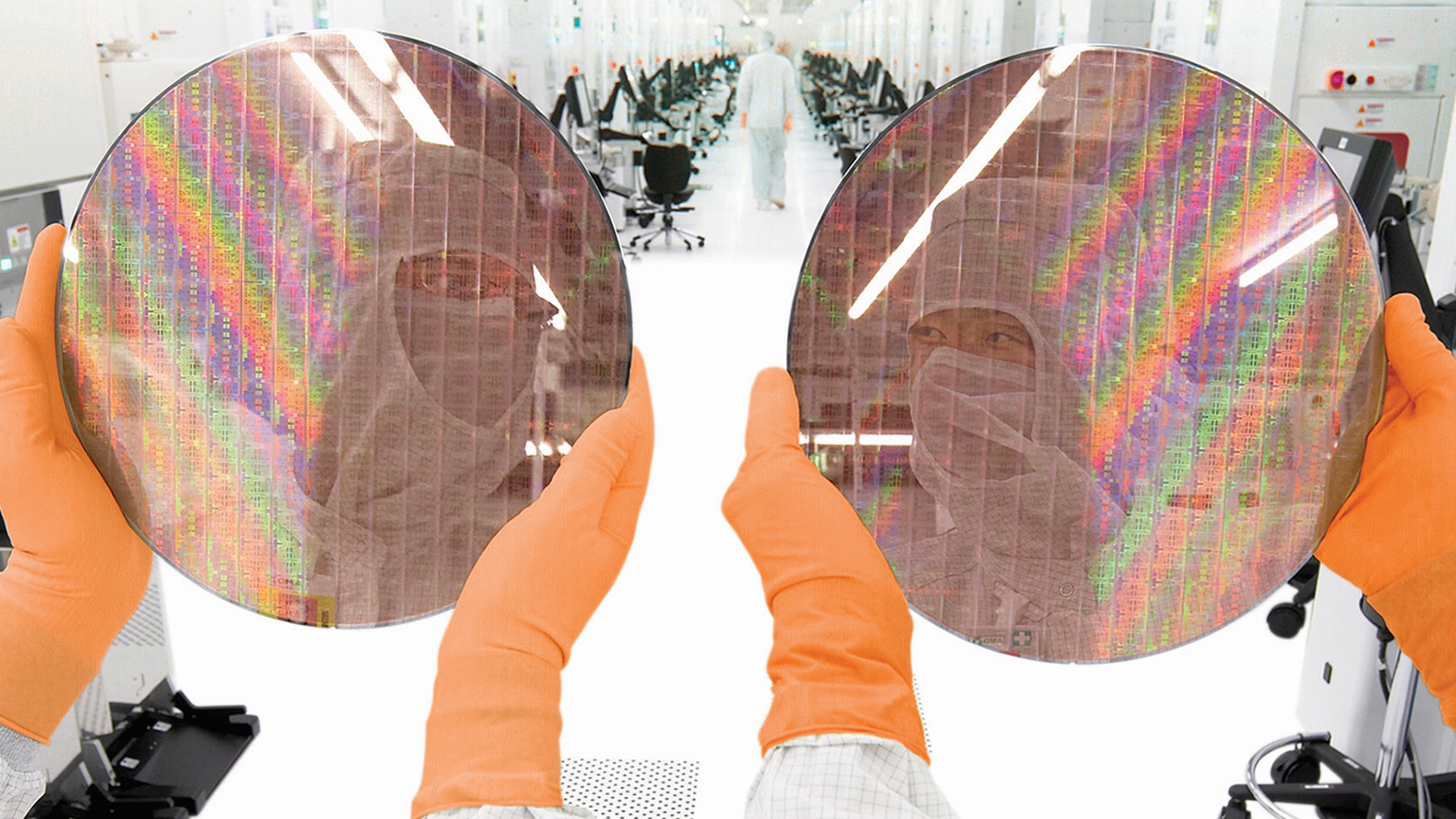

Founded in 1987, TSMC was the world’s first pure play foundry that manufactured chips for others. In 34 years of its history, the company has grown from a small entity with one fab to a multi-billion corporation with five 300mm fabs, seven 20mm fabs, and one 150mm production facility. Having developed dozens of process technologies throughout its history and having installed vast production capacities, TSMC can offer services to almost any fabless chip designer with almost any requirements. At present, TSMC serves over 460 customers.

As the demand for leading-edge fabrication processes and volumes from its large customers (such as Apple, HiSilicon, Qualcomm, Nvidia, and AMD) have grown in recent years, TSMC intensified building of new GigaFabs — production facilities with a capacity of more than 100,000 300-mm wafer starts per month (WSPM). Each costs around $20 billion, and TSMC also increased its research and development (R&D) budgets. The strategy has paid off and today TSMC has not only left Intel and Samsung Foundry behind with its manufacturing technologies, but it also has more leading-edge capacity than other makers of semiconductors. This is largely because because it serves virtually all fabless designers that require advanced technologies.

This year the company decided to radically increase its capital expenditure (CapEx) spending to $25 billion ~ $28 billion, an increase of 45% ~ 62% year-over-year from $17.2 billion in 2020. IC Insights believes that TSMC will “begin what is likely to be a huge multi-year ramp of spending,” and expects the company to boost its CapEx budget in 2022 and 2023 once again.

Being the leading maker of semiconductors both in terms of volumes and in terms of technology leadership has its advantages. First, it’s easier to get the fab tools when you buy them in high volumes. Second, it’s easier to set up your own production and supply chain standards, something that is tremendously important in an industry that is all about standardization.

Samsung Foundry: Closing the Gap with TSMC, Widening the Gap with Intel?

Samsung Electronics has been the world’s largest maker of dynamic random access memory (DRAM) and NAND flash for quite a while and has been in the semiconductor business for decades. Furthermore, it has produced various chips for its own needs. The company started to offer foundry services in mid-2000s, as it realized that only the largest chipmakers will survive in the long term. Samsung Foundry has been trying to catch up with TSMC for years, and while the gap is closing, it is still not quite there yet.

Samsung Foundry’s largest customer is still its parent company Samsung, which strives to make the world’s best smartphones, televisions, PCs, displays and other electronics. To that end, SF’s design decisions at times resemble those of an integrated device manufacturer (IDM) that makes money on actual products rather than on manufacturing services.

Samsung realized early enough that demand for chips (all chips, including DRAM, 3D NAND, SoCs, etc.) will only grow, so its corporate semiconductor CapEx spending exceeded $10 billion for the first time in 2010. Having spent $93.2 billion on expanding production capacities over the 2017–2020 period, the company significantly closed the gap with TSMC from a capacity point of view.

Samsung Foundry is still about three times smaller than TSMC in terms of wafer starts per month (and also in terms of the number of nodes it offers), but the gap between the two has been closing. So far, Samsung has not unveiled its 2021 semiconductor CapEx budget, but analysts believe that it could spend at least as much as it spent last year — around $28.1 billion.

Cumulative CapEx of Samsung and TSMC will total approximately $55.5 billion this year, according to IC Insights. A significant part Samsung’s funds will of course be used to buy equipment for Samsung’s memory businesses, but these two companies will be able to influence development of fab production tools and supply chains.

Should Intel Worry?

Intel traditionally spends tens of billions of dollars on CapEx (it spent about $14.3 billion last year), so it will remain a leading maker of processors. Yet, its spending on fabs will be about half that of Samsung and TSMC this year. Furthermore, since Intel will not start production of chips using a node that relies on EUV, it will not have an immediate significant influence on development of the industry and supply chains.

Historically, Intel had several competitive advantages that set it apart from all of its direct and indirect rivals:

- Intel’s CPUs were the fastest in the industry.

- Intel’s microarchitectures and CPU designs were scalable for all market segments.

- Intel had enough power to ensure that its architectural innovations were supported by software makers.

- Intel had the best process technologies, which could offset certain imperfections of its microarchitectures or design.

- Intel could produce CPUs in volumes unachievable by any of its competitors.

- Since Intel was the de facto leader of the semiconductor market both financially and technologically, it set standards for the rest of the industry, which further ensured its leadership position.

- While Intel competed against most companies in the semiconductor industry, it could build alliances or partnerships that strengthened it (e.g., with Microsoft, Dell, HP, Apple, and ATI Technologies) and helped it to better compete.

- Intel spent hundreds of millions of dollars on marketing and advertising, usually more than all of its rivals combined.

So far, Intel has lost at least three out of eight advantages. These days Intel’s CPUs are not the undisputed leaders, and in many cases competing products from AMD are unchallenged. While Intel’s 2nd generation and 3rd generation 10nm fabrication technologies are competitive against TSMC’s N7, the company’s nodes cannot offer the same transistor density as TSMC’s N5. Finally, Intel no longer spends as much as its rivals on fabs and no longer has technological leadership.

If/when AMD becomes TSMC’s second largest customer, it could ask its production partner to customize the nodes it uses in a bid to gain performance and/or lower power consumption. Meanwhile, we still know nothing about Intel’s outsourcing plans other than the fact that some of its products will be made at TSMC in 2022.

Intel remains a driving force behind many industry initiatives, and no technology can get widespread in the PC world without Intel’s support. Yet, there are no more Wintel-like initiatives and Intel is no longer an exclusive CPU supplier for companies like Apple.

Meanwhile, Intel has extremely capable x86 CPU architectures that offer higher single-thread performance when compared to those from AMD. Intel also produces more processors than any other maker, and it can supply its partners with volumes of chips not available from anyone else. Given Intel’s market share and volume leadership, virtually all of its initiatives are supported by the software industry. Furthermore, the company knows how to advertise its products and promote its brand.

In general, Intel has many things to worry about, as it no longer can compete against all of its rivals on all fronts successfully. Hopefully, the company’s new CEO will shed some light on the chip giant’s future plans next week in a live chat.

Could Countries Compete Against Dominant Makers of Semiconductors?

Now that TSMC and Samsung spend around $28 billion each on manufacturing facilities and billions on R&D, it is extremely hard for a commercial company to catch up with these chipmakers. Even Apple, with its massive earnings and cash reserves, is hardly willing to invest tens of billions on chip manufacturing. In the recent years, the governments of the EU, US, and China started to talk about local semiconductor production industries and expressed willingness to assist chipmakers.

IC Insights deems that it is close to impossible to catch up with TSMC and Samsung. Keeping in mind the two leading makers of semiconductors are way ahead of the industry both in terms of R&D and CapEx, analysts believe that “governments would need to spend at least $30 billion per year for a minimum of five years to have any reasonable chance of success.” The Chinese corporation SMIC has received a lot of help both from local authorities and Chinese government over the years, but the company is still about five years behind GlobalFoundries, Samsung Foundry, and TSMC.

Summary

Both TSMC and Samsung Foundry started to use EUV tools to produce chips using their leading-edge process technologies several years before Intel, so they have been gaining experience with new tools and supply chains for quite a while now.

Both TSMC and Samsung will invest two times more in their production facilities than Intel will in 2021. Arguably, Intel does not need to spend as much as TSMC and Samsung on CapEx since it only produces chips for itself, whereas its peers offer foundry services. Yet, previously Intel’s technological leadership was enabled by massive spending on fabs and R&D.

In theory, governments could stimulate development of the local semiconductor industry using direct help, tax breaks, and incentives. However, their total spending over the next five years would need to exceed $150 billion, and chances of success are not high.