Image 1 of 2

Image 2 of 2

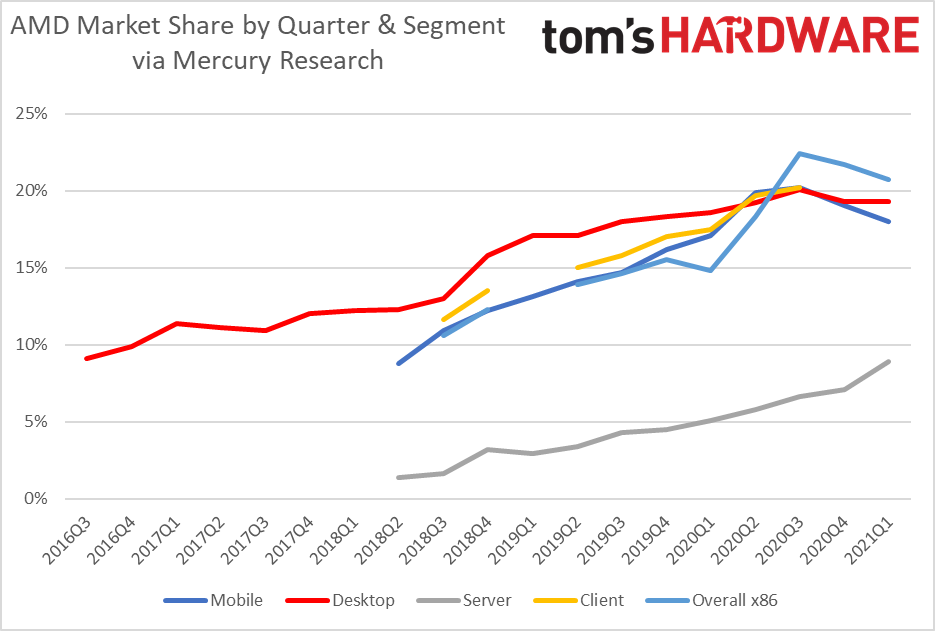

The Mercury Research CPU market share results are in for the first quarter of 2021, which finds AMD scoring its highest single-quarter market share increase in the server market since 2006, leading to record revenue as it steals more sockets from Intel. Those share gains are isolated, though, as AMD lost share in the notebook segment and overall market share while remaining flat in desktop PC chips. Those regressions might not be as problematic as they appear on the surface, though, due to AMD’s shift to producing pricier chips that generate more profit. (We have the full breakdown for each segment at the end of the article).

“While we don’t often discuss average selling prices, we note that this quarter saw unusually strong price moves for AMD — as AMD shipped fewer low-end parts and more high-end parts, as well as shipping many more server parts, the company’s average selling price increased significantly,” said Dean McCarron of Mercury Research.

It’s clear that AMD has prioritized its highest-end desktop PC models and its server chips during the pandemic-induced supply chain shortages. These moves come as the CPU market continues to move at a record pace: Last quarter marked the second-highest CPU shipment volume in history, second only to the prior quarter. Also, the first quarter usually suffers from lower sales volume as we exit the holiday season, but the first quarter of 2021 set yet another record – the 41% on-year gain was the highest for the CPU market in 25 years.

These developments benefit both companies, but AMD has clearly suffered more than Intel from the crushing combination of supply shortages and overwhelming demand. AMD actually recently lost share to Intel in both notebooks and desktop PCs for the first time in three years, but it reminded at a flat 19.3% of the desktop PC market during the quarter, meaning it stopped the slide despite supply challenges.

However, Intel’s Rocket Lake processors landed right at the end of the quarter, and they’re particularly competitive against AMD’s Ryzen 5000 in the lower end that tends to move the most volume. Additionally, these chips are widely available at retail at very competitive pricing while AMD’s chips are still a rarity on shelves at anywhere near the suggested selling price. That will make the results of the next quarter all the more interesting.

Both Intel and AMD set records for the number of units shipped and revenue during the quarter for mobile chips. AMD couldn’t stop the slide in notebook PC chips, but as McCarron points out, the company has prioritized higher-priced Ryzen “Renoir” 5 and 7 models while Intel has grown in its lower-margin and lower-priced Celeron chips. AMD slipped 1 percentage point to 18% of the notebook PC unit share.

Most concerning for Intel? It lost a significant amount of share to AMD in the profitable server market. AMD notched its highest single-quarter gain in server CPU share since 2016 at a growth of 1.8 percentage points, bringing the company to 8.9% (a few caveats apply, listed below).

While a 1.8 percentage point decline doesn’t sound too severe, it is concerning given the typically small changes we see in server market share. Intel’s data center revenue absolutely plummeted in the first quarter of the year, dropping 20% YoY while units shipped drop 13%, but Intel chalked that up to its customers pausing orders while ‘digesting’ their existing inventory. However, AMD’s financial results, in which the company’s server and semi-custom revenue jumped 286%, imply that Intel’s customers were actually digesting AMD’s chips instead.

AMD’s strong gains in server CPU share during the quarter occurred before its newest AMD EPYC Milan chips and Intel’s newest Ice Lake chips had their official launch, but both companies began shipping chips to their biggest customers early this year/late last year. Additionally, samples of these chips are in customers’ hands long before general availability, so large volume purchases are often decided long before server CPUs hit the shelves.

AMD’s big supercomputer wins with its EPYC Milan chips foretold strong buy-in from those seeking the highest performance possible, and it appears that momentum has carried over to the broader server CPU market. Given that most of these customers already know which company they’ll use for their long-term deployments, it is rational to expect that AMD’s server charge could continue into the next quarter.

Finally, AMD lost 1 percentage point in the overall x86 CPU market share, receding to 20.7%. Again, this comes as the company struggles from pandemic-induced supply chain shortages that it is minimizing by prioritizing high end chips. Meanwhile, Intel is leveraging its production scale to flood the lower-end of the market and gain share, but that comes at the expense of profitability.

Below you’ll find the specific numbers for each segment, complete with historical data.

| 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 1Q18 | 4Q17 | 3Q17 | 2Q17 | 1Q17 | 4Q16 | 3Q16 | |

| AMD Desktop Unit Share | 19.3% | 19.3% | 20.1% | 19.2% | 18.6% | 18.3% | 18% | 17.1% | 17.1% | 15.8% | 13% | 12.3% | 12.2% | 12.0% | 10.9% | 11.1% | 11.4% | 9.9% | 9.1% |

| Quarter over Quarter / Year over Year (pp) | +0.1 / +0.7 | -0.8 / +1.0 | +0.9 / +2.1 | +0.6 / +2.1 | +0.3 / +1.5 | +0.3 / +2.4 | +0.9 / +5 | Flat / +4.8 | +1.3 / +4.9 | +2.8 / +3.8 | +0.7 / +2.1 | +0.1 / +1.2 | +0.2 / +0.8 | +1.1 / +2.1 | -0.2 / +1.8 | -0.3 / – | +1.5 / – | +0.8 / – | – |

| 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | Q419 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | |

| AMD Mobile Unit Share | 18.0% | 19% | 20.2% | 19.9% | 17.1% | 16.2% | 14.7% | 14.1% | 13.1% | 12.2% | 10.9% | 8.8% |

| Quarter over Quarter / Year over Year (pp) | -1.0 / +1.1 | -1.2 / +2.8 | +0.3 / +5.5 | +2.9 / +5.8 | +0.9 / +3.2 | +1.5 / +4.0 | +0.7 / +3.8 | +1.0 / +5.3 | +0.9 / ? |

AMD bases its server share projections on IDC’s forecasts but only accounts for the single- and dual-socket market, which eliminates four-socket (and beyond) servers, networking infrastructure and Xeon D’s (edge). As such, Mercury’s numbers differ from the numbers cited by AMD, which predict a higher market share. Here is AMD’s comment on the matter: “Mercury Research captures all x86 server-class processors in their server unit estimate, regardless of device (server, network or storage), whereas the estimated 1P [single-socket] and 2P [two-socket] TAM [Total Addressable Market] provided by IDC only includes traditional servers.”

| 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 4Q17 | |

| AMD Server Unit Share | 8.9% | 7.1% | 6.6% | 5.8% | 5.1% | 4.5% | 4.3% | 3.4% | 2.9% | 3.2% | 1.6% | 1.4% | 0.8% |

| Quarter over Quarter / Year over Year (pp) | +1.8 / +3.8 | +0.5 / +2.6 | +0.8 / +2.3 | +0.7 / +2.4 | +0.6 / 2.2 | +0.2 / +1.4 | +0.9 / +2.7 | +0.5 / +2.0 | -0.3 / – | +1.6 / 2.4 | +0.2 / – |

| 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 4Q18 | 3Q18 | ||

| AMD Overall x86 | 20.7% | 21.7% | 22.4% | 18.3% | 14.8% | 15.1% | 14.6% | 13.9% | 12.3% | 10.6% |

| Overall PP Change QoQ / YoY | -1.0 / +6.0 | -0.7 / +6.2 | +4.1 / +6.6 | +3.5 / +1.2 (+3.7?) | -0.7 / ? | +0.9 / +3.2 | +0.7 / +4 | ? | ? | – |