Mubadala Investment Co. has started preparations for GlobalFoundries’ initial public offering (IPO), which is expected in late 2021. As chip demand is surging and the industry is suffering from shortages, GlobalFoundries’ business is expected to thrive.

Bloomberg reported this week that Mubadala has initiated talks with potential advisers about an IPO of GlobalFoundries in the U.S., eyeing a $20 billion valuation. The sovereign investment fund has not yet selected underwriters for the listing, which isn’t surprising as it previously targeted a 2022 IP — more than a year away. But that timeframe could be pushed forward. The discussions are private, so neither Mubadala nor GlobalFoundries have confirmed the report.

Mubadala belongs to the government of Abu Dhabi, so it’s standard for it to invest in companies and then sell their shares when the time is right. The company used to be the largest stakeholder in AMD, but sold its shares over the last three years to gain huge profits.

Making the Foundry Business More Profitable

GlobalFoundries management and Mubadala have been talking about IPO as a strategic target for years now. But before listing or starting an IPO process, the company’s business has to be attractive for potential investors, in terms of both current numbers and future potential. Given the current shortages for chips in all sectors of the technology industry, the time may now be ripe for a sale.

On the operational level GlobalFoundries is profitable, according to its management. However, since Mubadala has poured in tens of billions of dollars in GlobalFoundries over the years, it will take some time to depreciate these investments, so the company currently is not profitable overall. Meanwhile, GlobalFoundries no longer spends billions on leading-edge process technologies, in the hopes of reaching net profitability quicker.

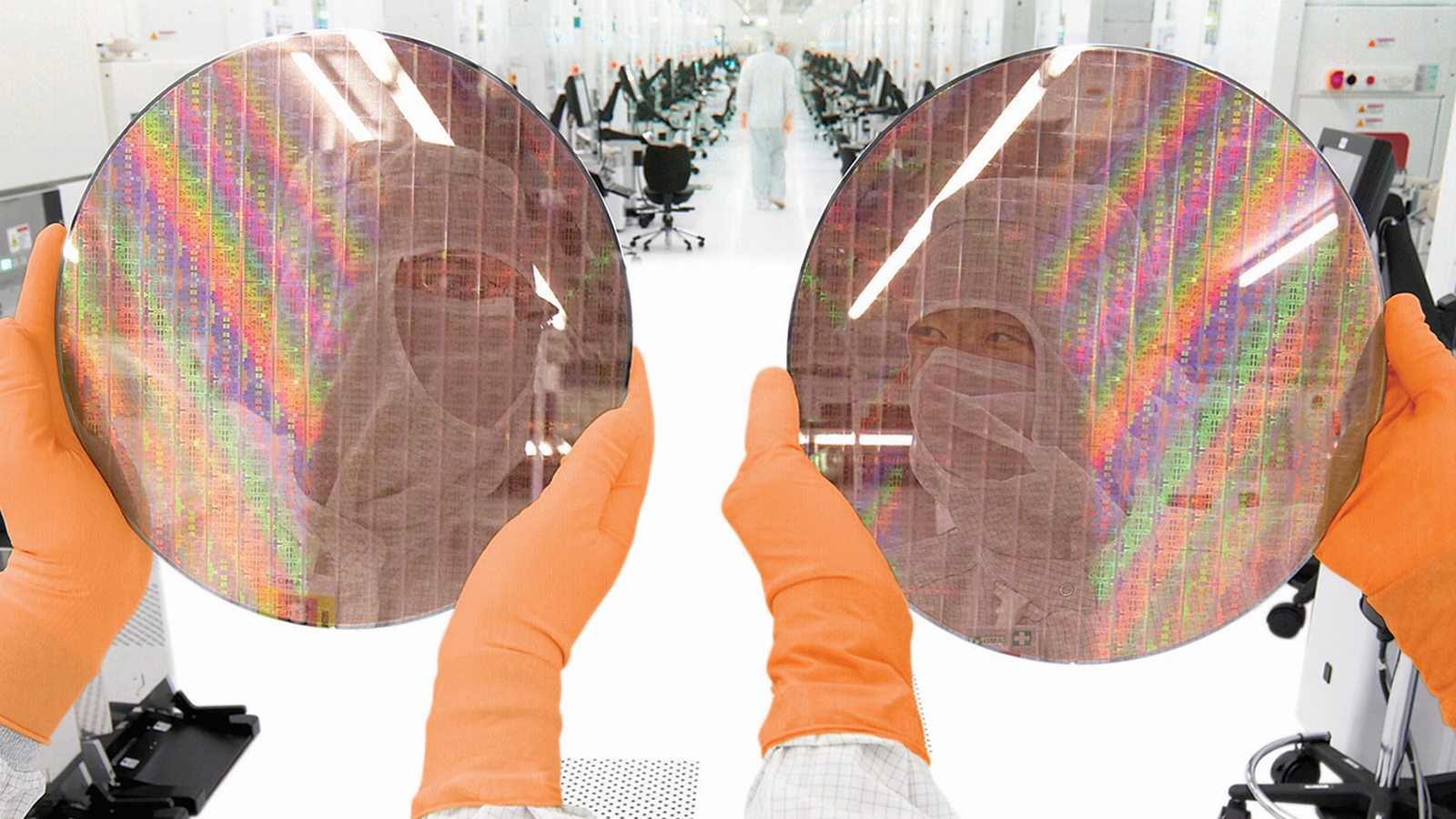

The most recent preparation for this came in 2018, when Mubadala appointed Thomas Caulfield as the new CEO of the company. One of the first things he did as head of the company was to abandon development of leading-edge fabrication processes (and cancelled further development of the 7LP nodes) in favor of specialty nodes with perhaps lesser revenue and profit potential but greater potential around long-term contracts and profitability.

Eventually, Caulfield sold Fab 3E in Singapore to Vanguard, sold Fab 10 in East Fishkill, NY to ON Semiconductor, and sold a photomask facility in Burlington, NY to Toppan Photomasks.

Pros and Cons

How attractive is GlobalFoundries to investor’s? That’s a big and interesting question. The time to invest in semiconductors seems to be good, as the market is booming and should keep growing for years, since the world is increasing consumption of chips.

But since it sold its fabs, GlobalFoundries has been losing sales and market share for a while. Furthermore, its business is not growing as fast as the likes of TSMC, Samsung Foundry, and UMC, according to TrendForce. There are other considerations too.

GlobalFoundries has very good positions in the U.S. and Europe, where it has its most capable fabs. Yet, Intel is also entering the foundry market, TSMC is set to build a fab in the U.S. and Samsung Foundry is going to follow suit. Those fabs shouldn’t immediately compete with GlobalFoundries because they will process chips using 5nm or 7nm nodes, which GlobalFoundries doesn’t offer. But eventually GlobalFoundries will surely have to face its U.S. rivals, one way or another.

Furthermore, companies like TSMC, Samsung Foundry and Intel are accelerating spending on fabs to tens of billions of dollars a year, which will leave GlobalFoundries significantly behind in terms of available capacity. GlobalFoundries has loads of space available in its Fab 1 in Dresden, as well as in Fab 8 in New York, so it can expand its capacity relatively quickly, something the company talked about last year. But significant spending may distract some investors.

With all this in mind, it’ll be interesting to see how GlobalFoundries’ IPO pans out. The IPO could also prompt GlobalFoundries to alter course and reconsider investing in leading-edge nodes, as that’s clearly where the greatest demand lies. We should find out later this year or early in 2022.