Intel is committed to building a leading-edge fab in Europe, but to do so the company will need almost $10 billion in subsidies, CEO Pat Gelsinger said in an interview with Politico Europe, as confirmed by Reuters. The exec pointed to the need for $9.7 billion in subsidies during a visit to Europe, where he met with politicians and business executives and landed on Germany and Benelux as good candidates for Intel’s new fab.

“Geopolitically, if you’re in Europe, you want to be in continental Europe,” Gelsinger told Politico. “We think of Germany as a good candidate — not the only, but a good candidate — for where we might build our fabrication capabilities.” Other candidates include Belgium, Netherlands and Luxemburg.

Building semiconductor production facilities in Europe and the U.S. is tricky financially. Intel has to compete against South Korean and Taiwanese rivals that enjoy lower taxes, labor costs and government incentives. In fact, incentives and subsidies have historically made Taiwan a semiconductor boon.

“What we are asking from both the U.S. and the European governments is to make it competitive for us to do it here compared to in Asia,” Gelsinger said in an interview with Politico Europe, according to Reuters.

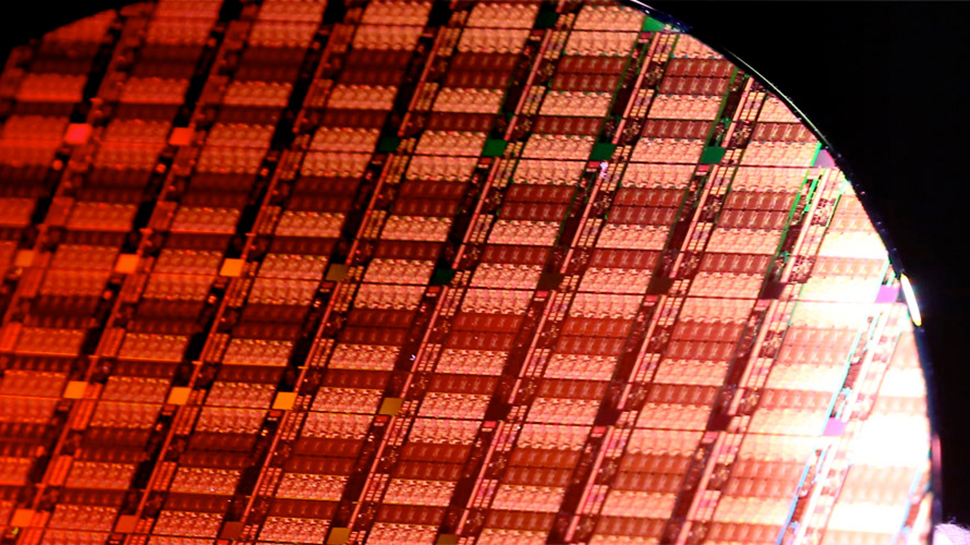

A plan to get some €8 billion ($9.7 billion) in subsidies, which may include incentives like tax breaks and direct investments, indicates that Intel is looking to build a fairly large and advanced fab in Europe. The project hasn’t begun to take shape yet, so it’s hard to accurately speculate on the fab’s specific purposes. However, wouldn’t be surprised to see a $25-$35 billion fab used to make both Intel’s own and third-party products.

Intel already has a site in Ireland that has been home for the company’s advanced fabs since the late 1980s. Right now, Intel is constructing a new EUV-ready fab at the site that will make chips using Intel’s 7nm fabrication technology. So far, Intel has invested approximately $22 billion (€18.6 billion) in its camp near Leixlip, Ireland.

But Intel needs more capacity as it engages into its IDM 2.0 strategy that involves internal manufacturing, outsourcing and offering contract manufacturing services under the Intel Foundry Services brand. As part of its IDM 2.0 plan, Intel already announced intentions to invest $20 billion in two new manufacturing facilities in Arizona.

This week, Gelsinger also reportedly met with execs from BMW, Deutsche Telecom and Volkswagen. He also met with Peter Altmaier, German Economy Minister, to discuss options. In addition, he met with executives from BMW and Deutsche Telecom, two long-time Intel customers. Some sources also noted that Gelsinger visited headquarters of Volkswagen Audi Group, though the chip giant has not confirmed this.