Japanese authorities have proposed that Sony Group and TSMC invest $9.2 billion in a fab that will produce chips using a 20nm process technology, reports Reuters citing a report by Nikkan Kogyo newspaper.

Just 15 years ago, Japanese companies like Panasonic and Renesas had leading-edge process technologies that could challenge those from Intel. Today, Japanese developers outsource chip production to companies like TSMC and UMC, and there are no advanced fabs in the country. The Japanese government understands the importance of domestic production, so recently, it proposed that Sony and TSMC build a semiconductor facility in the country.

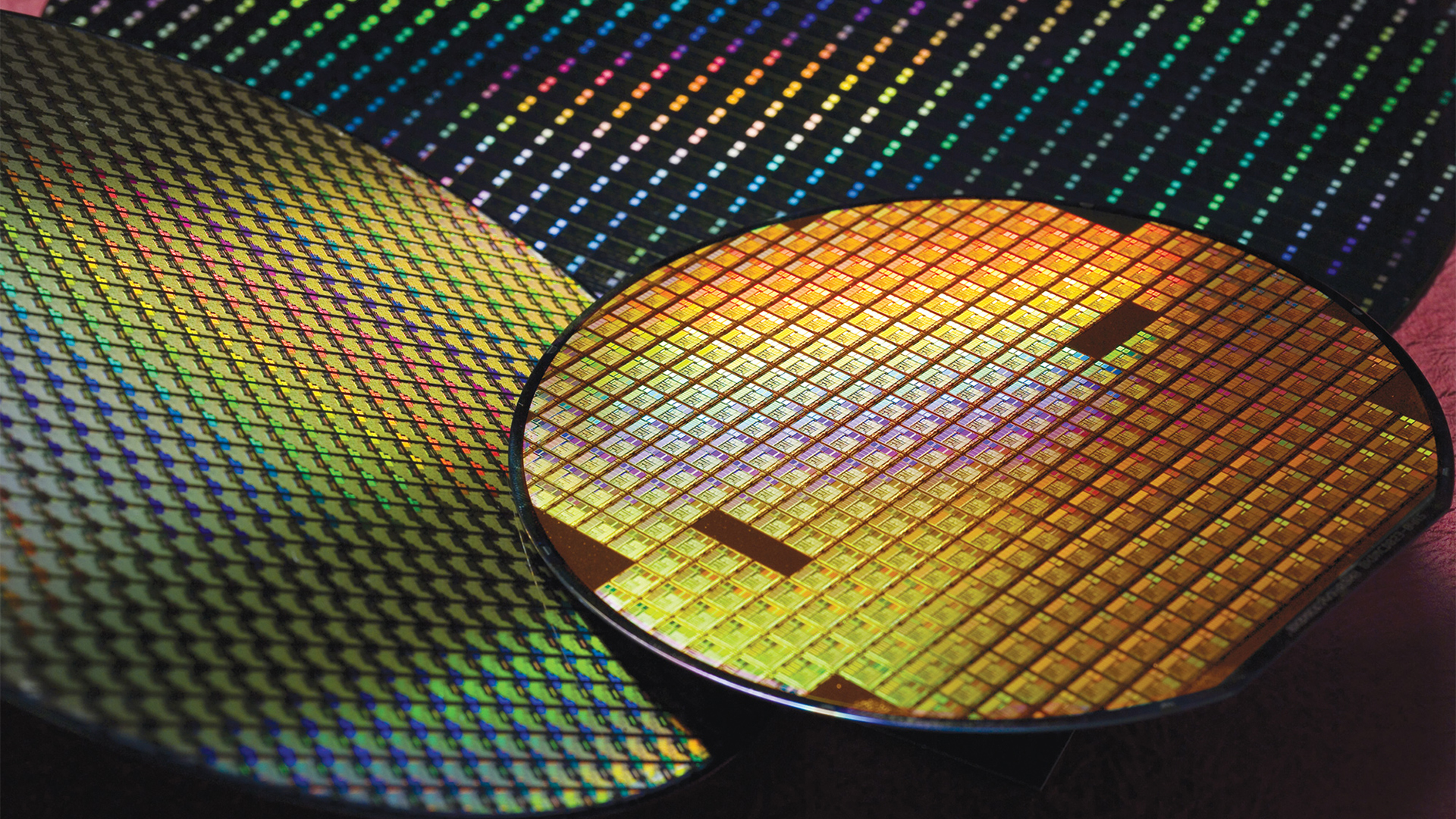

Japan’s most advanced chip production facility belongs to Renesas and produces semiconductors using the company’s 40 nm fabrication process. In contrast, companies like Panasonic and Fujitsu outsource production to TSMC and UMC. The new plant is expected to be built adjacent to Sony’s semiconductor plant in southwest Japan that mostly produces CMOS sensors.

TSMC built fabs in collaboration with its partners in the past, but this hasn’t happened recently. To that end, whether the company might be interested in building a fab with Sony remains to be seen.

Neither Sony nor TSMC commented on the story, but this is not the first report about Japan’s authorities’ fab efforts in recent months.

Earlier this year, TSMC announced plans to build a $171 million R&D center 50 km northeast of Tokyo, which incited rumors about the foundry’s possible plan to build a fab in Japan, too, according to Nikkei. Unlike Europe, Japan develops loads of chips domestically, so there is some rationale for TSMC to build a fab there.

TSMC’s 20nm fabrication process has never been popular among its clients largely because of its mediocre characteristics. Meanwhile, 20nm’s back-end-of-line (BEOL) is used for the company’s 16nm family of process technologies (which includes 16 nm and 12 nm nodes), so building a 20nm-capable TSMC fab makes quite a lot of sense for Japan.

While leading-edge process technologies, such as N5 and N7, account for the lion’s share of TSMC’s revenue, the industry uses mature process technologies for the vast majority of chips, so 20nm and 16nm technologies are rather optimal for consumer electronics and automotive industries, which are crucial for Japan.