According to IDC, PC sales in the first quarter were up 55% year-over-year, and since the demand for personal computers is growing, component sales in Q1 2021 were high, too. Jon Peddie Research reports that shipments of integrated and standalone graphics processing units (GPUs) for PCs increased 38.74% year-over-year in the first quarter, but Nvidia was the only company that expanded its market share in the rapidly-growing market.

| Q1 2020 | Q4 2020 | Q1 2021 | |

| AMD | 25% | 18% | 19% |

| Intel | 0% | 0% | 0% |

| Nvidia | 75% | 82% | 81% |

Here’s the tale of the tape for discrete GPU sales. Nvidia increased its discrete GPU share from 75% in Q1 2020 to 81% in Q1 2021.

In contrast, AMD’s share decreased from 25% in Q1 2020 to 19% in Q1 2021. The good news for AMD is that its share actually increased by 1% from the prior quarter, so its discrete GPU shipments and earnings were up, too.

Sales of standalone graphics processors (such as those used for higher-end laptops and discrete graphics cards) were quite high in the first quarter and totaled around 22 million units, as we know from last week’s report by Mercury Research. Jon Peddie Research clarifies that shipments of discrete graphics add-in-boards (AIBs) increased by 7% from the prior quarter, representing around 11.77 million units.

Although Intel started to ship its Iris Xe-branded standalone GPUs for low-end desktops and midrange notebooks in Q4, the company seems to report them as integrated graphics processors. As a result, it’s hard to say if the company has gained any standalone GPU market share over the recent months.

The Overall GPU Market

Three companies shipped a total of 119 million discrete and integrated GPUs in Q1. The vast majority of graphics processors come as integrated graphics units in CPUs, so CPU market-leader Intel sells the most graphics processors. In Q1, the blue giant commanded 68.18% of the total GPU market, a decrease of 0.5% quarter-over-quarter.

AMD came in second with a 16.65% share (a decrease of 0.12%), while Nvidia ranked third with a 15.17% share (an increase of 0.62%), according to JPR.

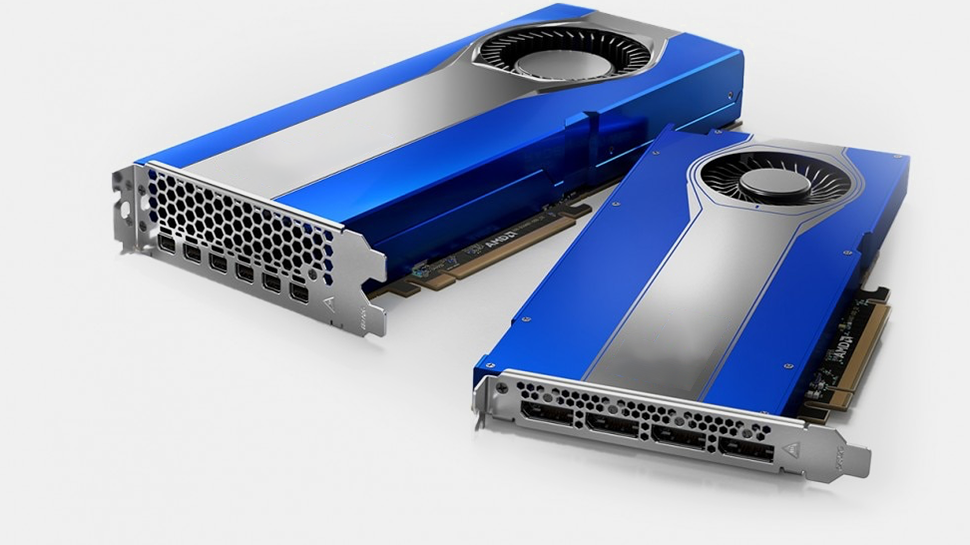

Both AMD and Nvidia recently introduced their performance-mainstream and notebook GPUs based on their latest RDNA 2 and Ampere architectures, so the competition between the two companies is set to intensify in the coming months.

However, GPU shortages abound, restricting opportunities. If the GPU makers can get more chips from their suppliers, we can expect them to continue to focus on supplying premium GPUs to earn higher revenue.