Skimming: Damage from data theft at ATMs at a record low

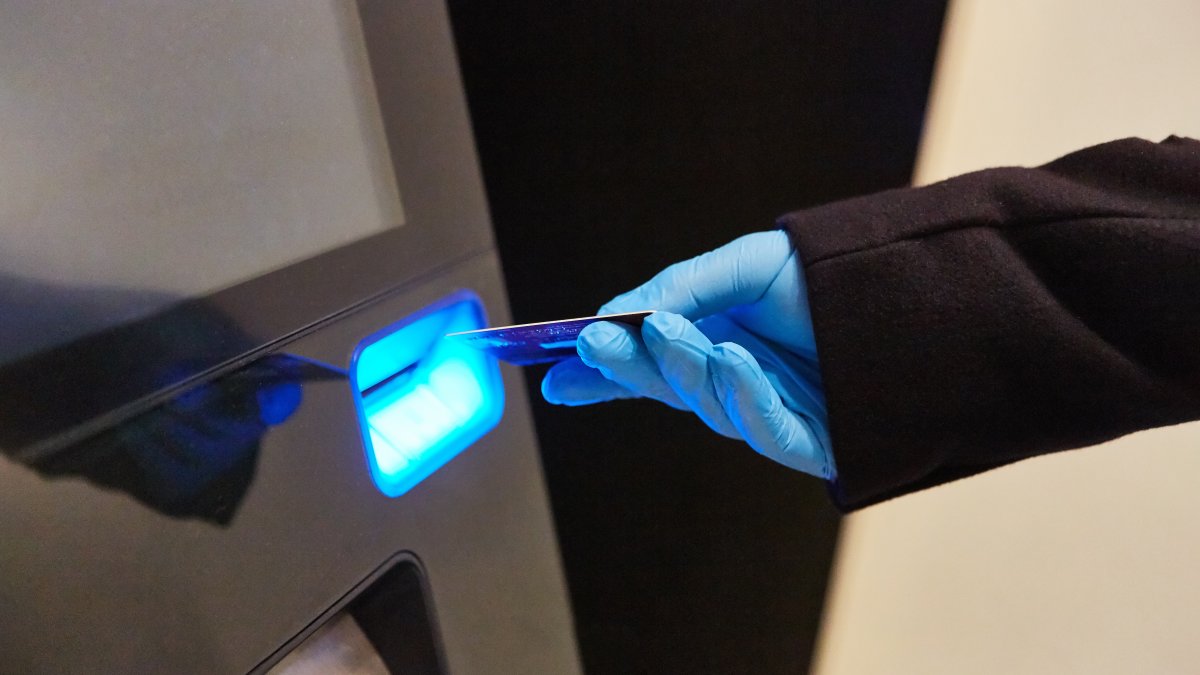

Source: Heise.de added 18th Jan 2021The damage caused by data theft at ATMs in Germany fell to a record low for the full year 2020. The Frankfurt facility Euro Kartensysteme puts the gross amount of the damage at around 1, million euros by so-called “skimming”, i.e. the spying out of card data and secret number (PIN).

2019 the “skimming” damage in Germany amounted to a little more than 1.4 million euros. In the year 2013 it was 11, 3 million euros, 2012 like 2011 even each 34 Million Euros. The financial sector attributes the decline primarily to investments in so-called EMV technology: Payment cards are equipped with a processor chip and the card is checked for authenticity every time it is used. Germany has been relying on this technology for years.

Banks mostly replace damage From January up to and including December 2020 criminals manipulated, according to information from Euro card systems, nationwide 152 times ATMs to get data from bank customers. The year before there had been 245 such “skimming” cases. Individual machines could have been attacked several times. Last year, data thieves struck especially in North Rhine-Westphalia (35 cases), Hesse (33) and Lower Saxony (20) to.

Consumers in Germany who have become victims of “skimming” do not normally have to fear any financial disadvantage. As a rule, financial institutions compensate for such damage – provided that customers have handled their bank card and PIN carefully. Thanks to international agreements, the local banking industry can now recover almost the entire loss amount. The countries with the lowest security standards have to pay for damage from fraudulent transactions with stolen card data.

Theft of payment cards is increasing In principle, counterfeit cards can only be used where payment cards are still equipped with relatively easy-to-copy magnetic strips and retail readers are designed for magnetic strips. 2020 there were duplicate cards based on data stolen in this country, especially in India (around 35 Percentage of damage), the USA (26, 6 percent) and Indonesia (15, 4 percent).

Much greater damage has occurred in Germany for years as a result of theft and loss of payment cards. Euro card systems registered an increase in the past year to 10. 839 (Previous year: 10 .790) Cases. The gross damage from loss and theft of cards rose from around 11 6 million euros to almost 15, 7 million euros. Many consumers make it easy for criminals because, despite all warnings, they keep their card and PIN together in their wallet.

(axk)

brands: 11 Especially Euro It local Million Replace media: Heise.de keywords: Payment

Related posts

Notice: Undefined variable: all_related in /var/www/vhosts/rondea.com/httpdocs/wp-content/themes/rondea-2-0/single-article.php on line 88

Notice: Undefined variable: all_related in /var/www/vhosts/rondea.com/httpdocs/wp-content/themes/rondea-2-0/single-article.php on line 88

Related Products

Notice: Undefined variable: all_related in /var/www/vhosts/rondea.com/httpdocs/wp-content/themes/rondea-2-0/single-article.php on line 91

Warning: Invalid argument supplied for foreach() in /var/www/vhosts/rondea.com/httpdocs/wp-content/themes/rondea-2-0/single-article.php on line 91