As leading makers increase their 3D NAND bit output, prices of flash memory drop due to oversupply. This leads to sinking prices for solid-state drives as other types of NAND-based storage devices. Analysts from TrendForce predict that next quarter prices of client and server SSDs will drop by another 10% to 15% compared to Q4 2020.

3D NAND ASPs Set to Drop

There are six major makers of 3D NAND and a number of niche/local flash memory suppliers on the planet today, many more than there are DRAM manufacturers. All of these producers compete fiercely against each other both for market share and for technology leadership.

These companies regularly introduce new 3D NAND process technologies that increase the number of layers (i.e., bit density) and/or make new memory architectures (e.g., QLC, PLC) more viable for certain applications. In addition, leading makers methodically add 3D NAND capacity as they see increasing demand for their products. As a result, 3D NAND bit supply grows both as a result of technological advancements and because of new capacities.

Analysts from TrendForce estimate that client SSDs currently account for 31% of 3D NAND bit supply, enterprise drives consume 20%, eMMC/UFS storage devices use 41% of 3D NAND bits, whereas only 8% of 3D NAND bit output is sold as raw wafers.

TrendForce researchers claim that in Q1 2021 four 3D NAND makers — Intel, Samsung, SK Hynix, and YMTC — plan to expand their 3D NAND bit output, which will spark competition and will cause a 10% – 15% quarter-over-quarter decline of 3D NAND average selling price (ASP) in Q1 2021.

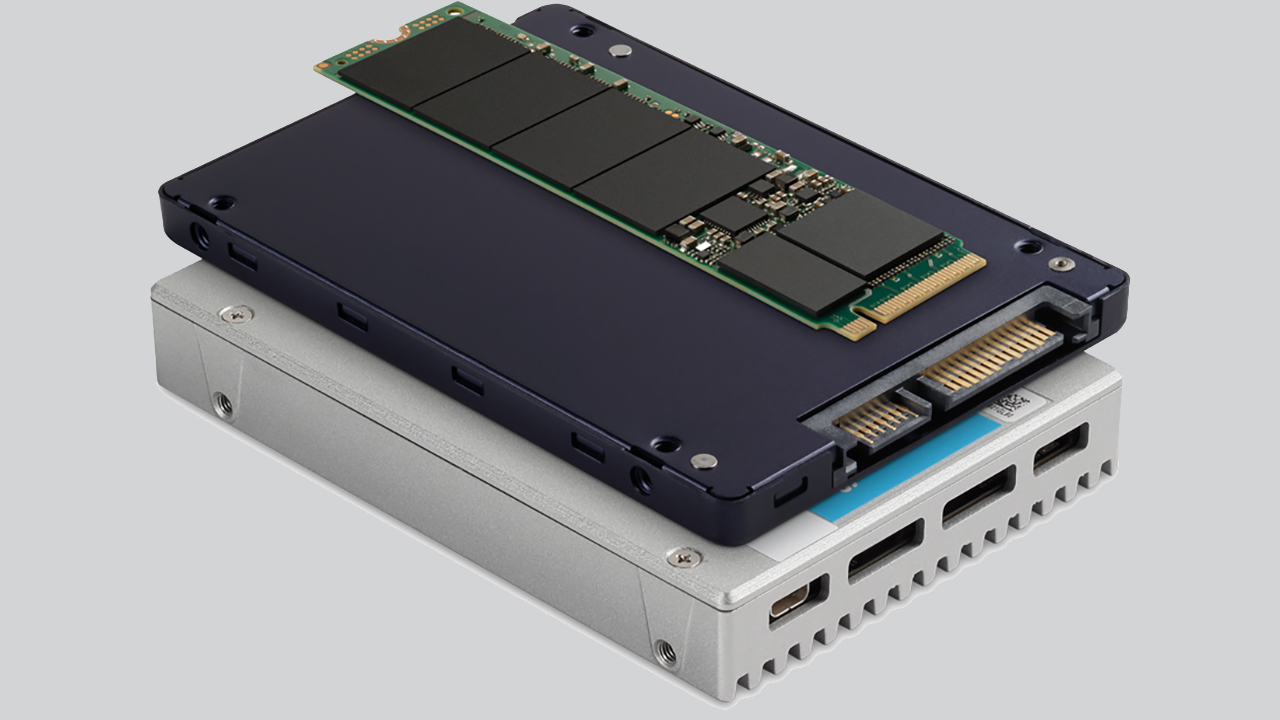

Client SSDs to Get Cheaper

Traditionally, PC makers decrease production of computers in the first quarter due to a seasonal downturn. As a result, demand for components, such as memory and SSDs, drops and their prices drop too. But there are two other factors that will drive them down in the first quarter of next year, according to TrendForce.

Firstly, PC makers have plenty of SSDs in their stocks already. Secondly, 3D NAND suppliers are actively sending samples of their 1xx-layer 3D NAND to SSD makers thus energetically supporting launch of new drives.

Demand for computers is high and PC makers have backorders to supply, so their current inventories will likely be consumed to satisfy current demand. Nonetheless, new drives based on 1xx-layer 3D NAND will still be cheaper on per-bit basis than existing SSDs. In any case, TrendForce predicts that client SSD prices will drop by 10% to 15% in Q1 2021.

Prices of Enterprise SSDs to Drop Too

As the ramp of Intel’s Xeon Scalable ‘Ice Lake-SP’ platform (also known as Whitley Gen 2) comes closer, server makers are beginning their transition from existing PCIe 3.0-based drives and intensify testing as well as certification of PCIe 4.0 SSDs from Intel, Samsung, and Kioxia, reports TrendForce.

The analysts expect that as competition on the enterprise SSD market intensifies in Q1 2021, prices of appropriate products will decrease by 10% to 15%.

eMMC/UFS Prices to Decline

Smartphones, tablets, and other types of portable electronics (such as low-end PCs) are usually among the first to start using new types of 3D NAND. Producers of eMMC and UFS storage devices usually use new types of memory to increase capacity of their devices, but this naturally boosts bit supply and reduces per bit prices.

Suppliers of eMMC and UFS plan to start transiting their products to 1xx-layer 3D NAND only after Q2 2021 in a bid not to oversupply. 64GB and higher capacity devices already use 92/96-layer 3D NAND, so without a new transition there will not be an oversupply in terms of bits.

As a result, TrendForce believes that due to dropping demand for everything towards the end of Q1, prices of mobile storage devices will drop by 5% to 10%.

Prices of 3D NAND Wafers Set to Drop

Many types of 3D NAND based products, including SSDs, flash drives, and memory cards, are in a state of oversupply, according to TrendForce. However, since it is difficult to get components, which are made by foundries, 3D NAND flash suppliers are diverting their production to wafer market.

According to the report, Samsung, the company that has historically focused on actual products and not on selling raw NAND, has begun shipping its 92-layer 3D NAND wafers to module houses. Western Digital, another company that tends to use its 3D NAND internally, has also started sampling of its 112-layer 3D NAND with select customers. Meanwhile, Kioxia continues to supply its 96-layer 3D NAND to clients, whereas SK Hynix is sampling its 128-layer memory.

Aggressive selling of high-density 3D NAND wafers to third-party SSD makers creates bit oversupply on the wafer market, which will cause a 15% quarter-over-quarter price drop in Q1 2021, the analysts predict.