The winter storm that savaged Texas in February might affect the tech industry for months to come. TrendForce said today it expects the shutdown of Samsung’s fab in Austin to contribute to a quarter-over-quarter increase in NAND flash pricing.

The research firm said that NAND flash pricing could rise 3-8% in the second quarter as supply of NAND flash controllers tightens. Samsung is a critical supplier of those controllers, which means delays to its fab’s re-opening will affect the entire industry.

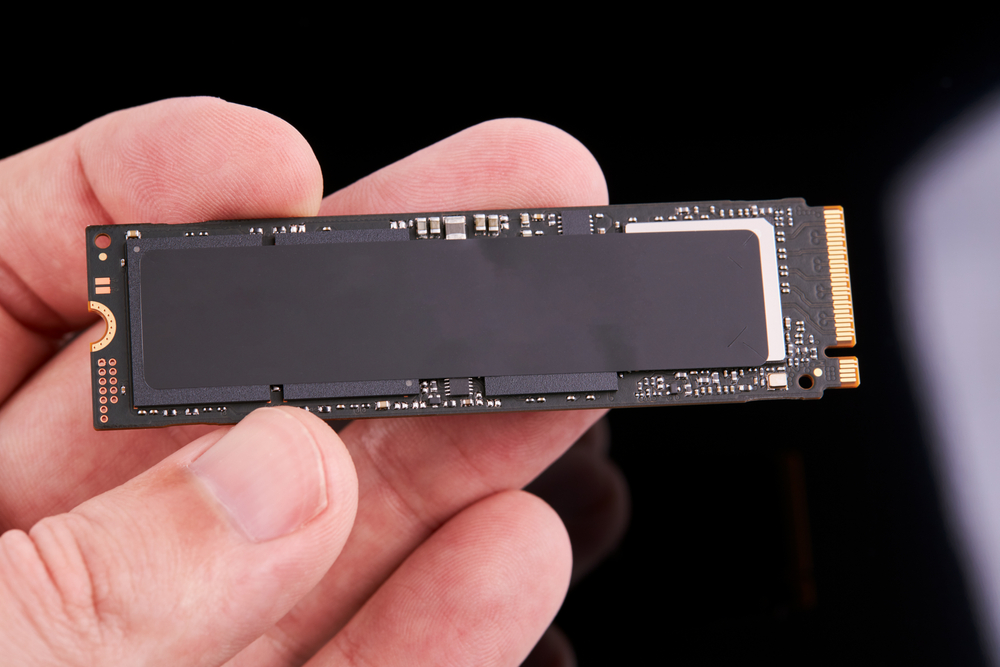

The predictions follow a DigiTimes report claiming the disruption of controller supply could halt production of up to 75% of Samsung’s PCIe SSDs in March. Samsung’s plan is to resume NAND flash controller production in April and shipping in May.

TrendForce said that limited supply will be paired with higher-than-anticipated demand from notebook manufacturers scrambling to keep pace with the pandemic-induced rise in consumer interest. (And pandemic-caused production delays, too.)

The research firm also said it expects both of those factors, along with “bids from Chinese telecom operators and increased IT equipment purchases from small and medium businesses globally” to help stabilize the enterprise SSD market in 2Q21.

These increases won’t offset the decline from 1Q21, when TrendForce put client and enterprise SSD pricing down 5-10% and 10-15%, and supply could level out soon. The firm predicted an up to 10% increase in NAND flash bit output next quarter.

But for now it seems the industry will have to wait with bated breath for Samsung to resume normal NAND flash controller production at its Texas factories. Until then, manufacturers are expected to stockpile however many SSDs they can get acquire.