Marc Liu, chairman of Taiwan Semiconductor Manufacturing Co., believes that it is economically unrealistic to expand production of semiconductors in the U.S. and Europe as this will create excessive capacity that will generate losses. TSMC has enough capacity currently to serve demand for chips, Liu said.

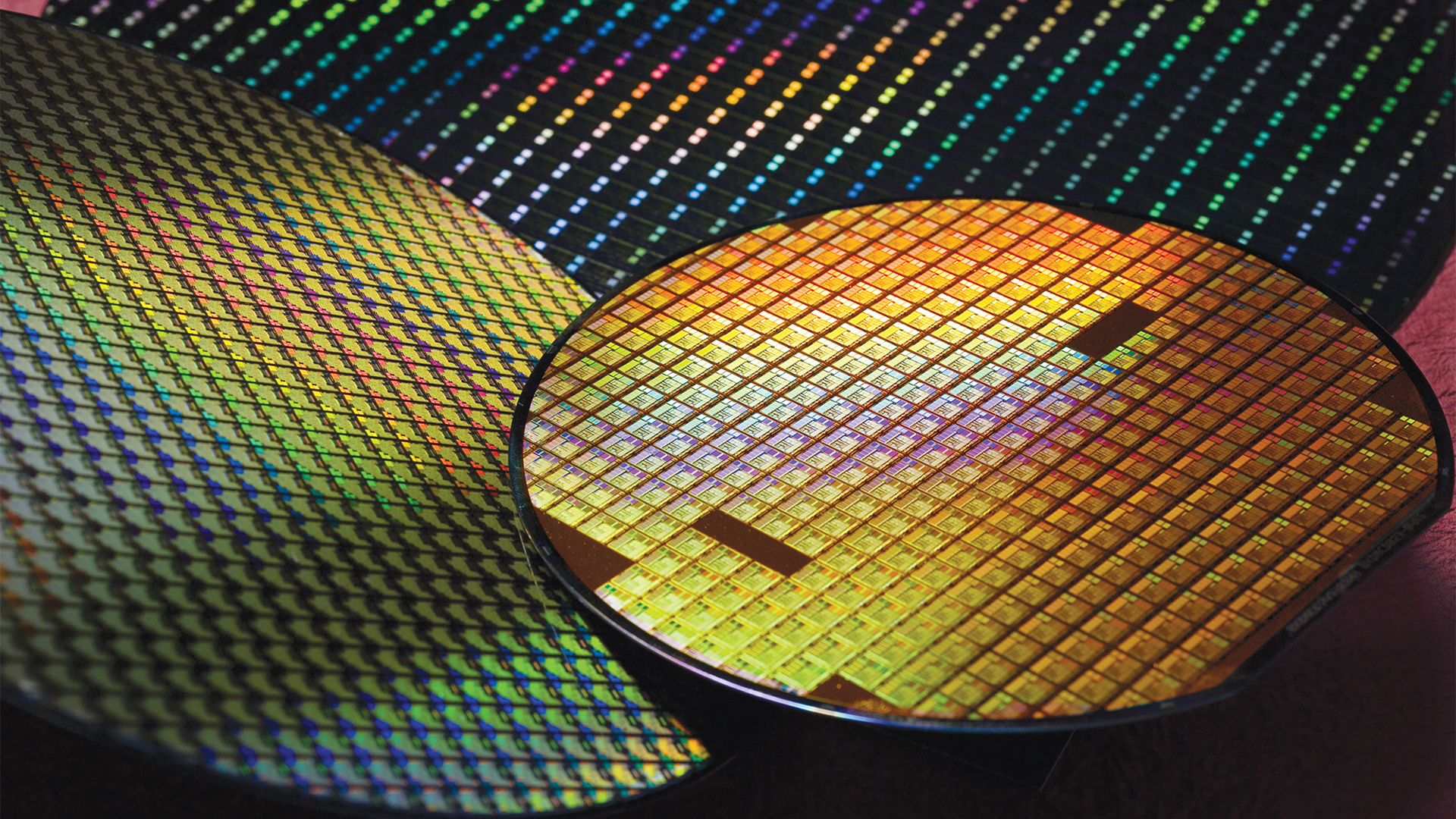

There are less than a dozen of companies and several countries on the planet that can make chips using advanced process technologies such as those found in the best CPUs. Historically, makers of semiconductors have built their multi-billion fabs in countries that had enough qualified workforce and could offer incentives to those willing to invest in manufacturing capacities.

Nowadays TSMC is the only contract maker of semiconductors that can manufacture chips using sub-12 nm nodes, but since demand for chips is exceeding supply, there is a shortage of chips that affects local economies in the U.S. and Europe.

To make the matters even more disturbing for Europe, the routes from Southeast Asia to the E.U. got more dangerous in the recent years due to piracy in the Gulf of Aden near Somalia as well as near Western Africa. Due to increasing concentration of chipmaking in Taiwan, chip shortages, increasing geopolitical risks, and local incidents like the recent Suez Canal blockage, politicians from Europe are now exploring ways to build additional fabs within their own borders. Meanwhile, The U.S. government as well as the States of Arizona, New York, and Texas are willing to support local chip manufacturing.

Modern semiconductor manufacturing facilities have to be very large to make financial sense and cost tens of billions of dollars. But since usual demand for chips does not always peak, such huge fabs may stand idle at times, generating massive losses for their owners, says Liu.

“Uncertainties led to double booking, but actual capacity is larger than demand,” said Liu, who is also the chairman of Taiwan Semiconductor Industry Association, reports Bloomberg. “How quickly those concerns are resolved really depends on future U.S.-China negotiations.”

In addition to uncertainties caused by geopolitics as well as pandemic, there are looming megatrends — 5G, AI, HPC, and edge computing — that will drive demand for chips. At present, it is hard to predict how high that demand will be, but these four emerging applications may be deemed strategically important, which means that governments may be willing to support manufacturing within their borders in a bid to diversify supplies and reduce risks even at high costs.

All of TSMC’s advanced fabs are located in Taiwan, but last year the company decided to build a 5nm-capable facility in the U.S. to serve local customers, so the company itself understands importance of production in the states for some of its clients

Excessive chip production capacities will affect pricing and profitability of manufacturers, so neither TSMC nor other foundries are interested in building them. But since chips are increasingly becoming strategically important, localization of their production may be something that will be supported both by politicians as well as large companies that consume chips, so TSMC might just have to start building fabs outside of Taiwan to stay competitive.