Intel has published the figures for the fourth quarter and the full year 2020. For the fifth year in a row, the chip giant can report a sales record. In the fourth quarter, sales were exactly 20 billion US dollars, which is about 200 Millions below the result a year ago, but is still a strong result. The fourth quarter is always the strongest at Intel in the full year.

The high turnover does not go hand in hand with an equally increased or constant profit, because here Intel has to decrease by 15% report year over year. Across the quarter, Intel also posted a plus here, but this is once again due to the strong fourth quarter. The lower margin is primarily due to higher taxes, which in the overall result of 14, 4% to 21, 8% increased. Of course, this has a significant impact on the result.

Broken down into the individual business areas, many groups have reported declines in sales. Across the quarter only the Client Group (to which the desktop and notebook processors belong) and the Automotive division Mobileye reported a plus. The data center, IoT and FPGA divisions report sales declines in the range of 16%. The Optane memory division is almost unchanged at -1%. Viewed over the full year, this looks a little better in most business areas than the quarterly comparison suggests.

The comparatively high turnover in the client division captures a large part of the lower turnover with its plus the other areas again. Intel is also benefiting from the pandemic situation in the form of high sales of notebooks. This area grew by 30%, while desktop processors posted a decrease of 9%.

But the first problems are becoming apparent, especially in the data center business. Intel justifies the declines here with the current competitive market and a certain “cloud cycle”. Ice Lake-SP, the next Xeon generation, is slated to go into mass production this quarter.

Light at the end of the tunnel

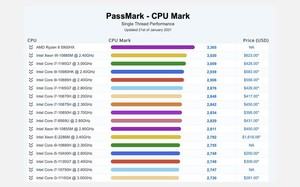

Even if AMD continues to increase the pressure in the notebook sector, Intel can still do this always growing the fastest and maintaining its strong market position. With the Ryzen Mobile 5000 processors and the notebooks presented so far, however, there are signs that the manufacturers in the high-end area are quite ready to move more away from Intel.

As a preview of 2021, Intel refers to Rocket Lake-S, the upcoming desktop platform, which is due to start this quarter. This also applies to the already mentioned Xeon processors based on Ice Lake-SP. For later in the year 2021 Intel is already planning Alder Lake for the client processors and Sapphire Rapids for the Xeon processors. To what extent Rocket Lake-S and Ice Lake-SP will have a positive effect remains to be seen.

Until 2023 7 nm is not gaining momentum

With regard to the coming years, the focus is certainly on Intel’s development of its own production. The delays at 10 nm currently have a strong effect, with 7 nm only 2023 to be ready has been confirmed several times by Intel, but the consequences of this will determine the coming months at Intel.

Some of the products will be sold in 10 nm SuperFin and later Enhanced SuperFin. But even if you want to increase the capacities further, you will not be able to manufacture everything yourself in 10 nm in the coming years. Whether and to what extent Intel will rely on external production or license production in its own factories will be decided in the coming weeks.

With the official takeover of the post as CEO by Pat Gelsinger on 15. A decision should be made in February. Gelsinger has now gained an overview and gave some interesting answers during the questions from analysts:

“I’ve seen the results of the great job the teams have done in last 6 months. I have confidence that most of our 2023 portfolio will be internal, but with an increasing use of foundry at the same time. I will take time to dig deeper, but I feel Intel is on a great path. “

Pat Gelsinger also assumes that Intel 2023 will largely stand on its own and firm feet again with regard to production. But even then, Intel will still be dependent on certain capacities of the foundry production. In the coming weeks Gelsinger will take a closer look at the available data and progress in order to then determine the procedure for the next two years.

“We ‘ re also pausing to look deeper into the roadmap for more clarity in the future. We also have adjustments in leadership too, also making adjustments in product leadership team over time. One of my favorite engineers Glenn Hinton announced he was coming back to the company today . The key leaders are coming back to Intel. Leadership, roadmap, a few more weeks of analysis will allow us to put Intel on a path. “

Gelsinger also refers to the return of Glenn Hinton, who was involved in the 90 years in the development of numerous micro-architectures and associated processors.