Since my train was stranded and the iPhone had nothing more to say, I listened to Helmut the bus driver. The air conditioning is currently insufficient, he said, so he got a coolkeeper, a special seat mat so that he doesn’t have to stew in his own juice the whole shift. Fortunately, he drives a diesel-powered bus and not an electric one, so you have to be careful with the energy and you can’t just turn up the air conditioning, even in the heat like it is now. Then it could happen that the bus simply stops on the route. “I don’t have a spare canister then,” he insisted.

While I was paddling through potatoes, I could as a native city dweller, don’t imagine living there; as always when I drove across the country, even as a child, when I visited relatives with my parents, just under an hour’s drive northwest of Nienburg. At least for some errands I would have to rely on the car, I probably couldn’t just take public transport to work or even cycle. That for me as a passionate pedestrian who can switch to a bike or tram in the city for a quick trip and handle larger transports with the sharing car or that of a friend. The foot pressure would probably be even stronger if I lived in Schwabing, where, according to a BMW study by 1997 all motorists combined Every day 80.00 should have spent 0 kilometers searching for a parking space.

Reserve canister Normally at the end of the day I can’t remember which topics I worked on during the working day. They can then no longer be queried directly, they seem to be shifted into a kind of foreshadowing memory. When I come across a topic, I suspect that I had it on the table not long or a long time ago, and I can narrow down the archive search accordingly. On this Tuesday, however, I had another dpa message in mind: “Car traffic causes follow-up costs of 141 Billion euro”. In the year 2017, the alliance had calculated per rail. The costs would not be borne by the polluters alone, but by the general public. Criticism came from the FDP that it was tendentious to argue only with the follow-up costs and to ignore the benefits of mobility. As liberals, in the tradition of Adam Smith, you mean, of course, the economic benefits for the benefit of all.

Mobility includes immobility, cars stand around most of the time . In the country there are endless parking spaces for this, where the prerequisites would be more likely to charge the electric car in front of one’s own front door, as most owners of such cars are currently doing in view of the thin infrastructure and long charging times. In the city, on the other hand, the proportion of rental accommodation is high, there are quite a few multi-party houses, like the one in which I live, and correspondingly little parking space. Many apartment buildings have no parking spaces that are suitable as charging stations. After all, the legislators want to promote the private installation of charging stations by strengthening the rights of tenants.

“Reserve canister” was my catchphrase, thinking about the now empty power bank, about the system, even paradigm shift that came with the switch from Xenium to iPhone. Always keep an eye on the charge level and thus the option benefits, and if it fell below a certain threshold, keep your eyes wandering to the nearest socket. If someone seemed to be reachable, “may I” ask and mark the area with a plug. Middle of 00 he years, when people with touchscreens increased in the trains and subways I used, it became common in some pubs – at least in Stuttgart I had seen this more often, less in Bremen – for people to have their smartphones in front of them laid the table. In a cozy atmosphere it became tight between the beer and wine glasses in a high-tech, status symbolic way.

Trimmed expectation On this last Tuesday in August 2019 it was just a week ago that Chancellor Angela Merkel expressed her expectation to like one on Germany’s streets Drive a million electric cars, from 2020 to 2022 had moved. Germany was still many thousands of electric vehicles away from the destination. An electric car is possibly a status symbol, but one that cannot be plugged in or put on the table.

The German fear of electromobility seems to be giving way, well encouraged by the Purchase premium offered by the state and manufacturers. From January to October 2020 were 121. 500 purely battery-electric powered cars newly registered, 130 percent more than last year. The federal government’s electromobility funding program has existed since July 2016 and was initially adopted very hesitantly. Four years later it is on many lips and often a quiet car sneaks past my living room window. The call of money is weighted on the scales against the fear of range, this special form of German fear.

“That’s why I wouldn’t buy an electric car privately. How should I go on vacation with it? “, the bus driver interrupted my thoughts from the future. “Please?” I winced. “I go to Spain with my wife every year,” said Helmut, “on the way I find petrol stations everywhere. But what about charging stations? Besides, after ten minutes I’m through with refueling. Do you know how long it takes to get one Fully charge your electric car? ” I thought of a message that I had written two years earlier: Three men had driven their Tesla from the North Cape to Tarifa and had 86 hours needed. Only for the loading went there 10 hours on it. In normal reality 70 percent of drivers in Germany daily maximum 50 kilometers, 17 percent between 50 and 100 km, Eon had found out through a survey. At the same time 20 percent expected from one E-car with a full charge between 141 and 500 km range, 21 Percent more than 500 km.

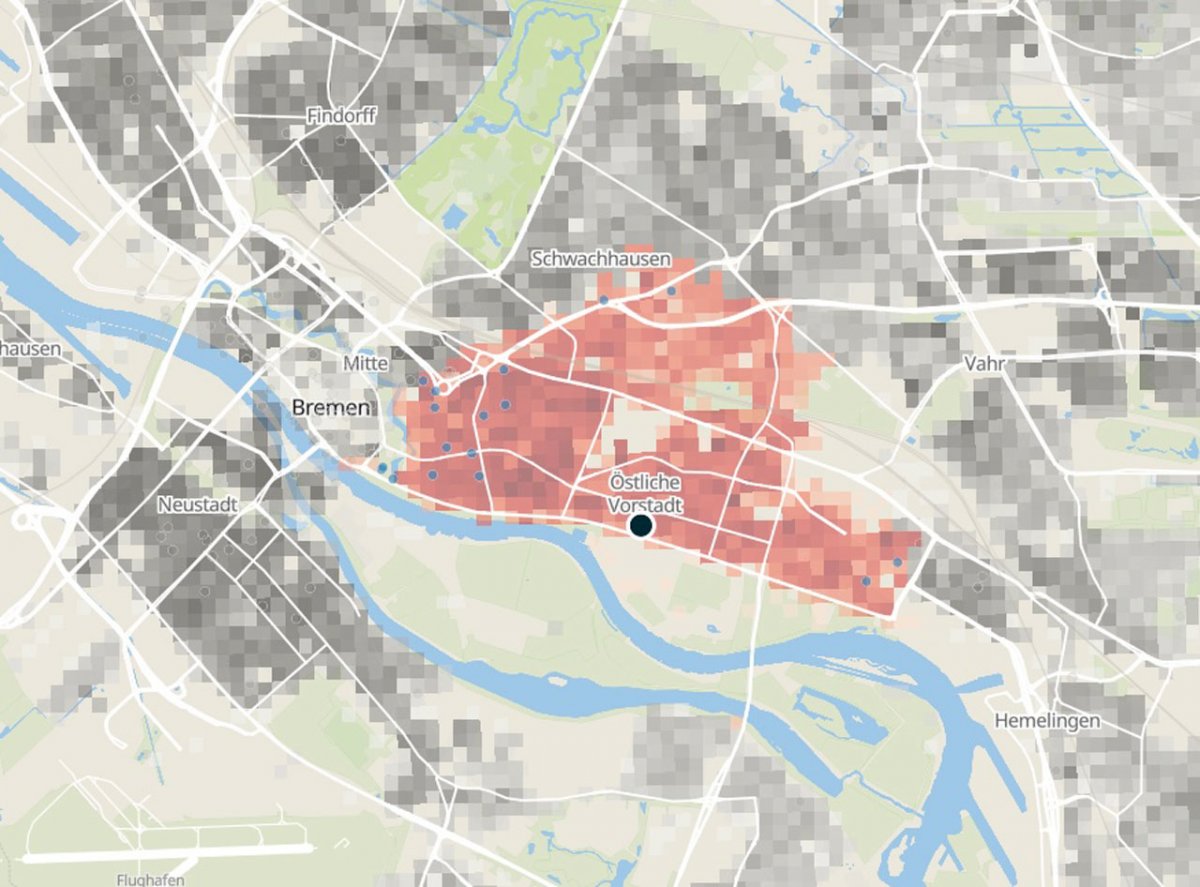

isochrones – Card by Francis Galton.

The British naturalist Francis Galton had 1881 produced an isochronous map. He colored areas on a world map that could be reached from a certain point – namely London – within a certain period of time. Within ten days to the Urals, 40 Days to Australia or central South America; Assuming the most favorable travel conditions and costs. The first electric cars were already around at that time, but I don’t know whether Galton included them in his considerations. Probably not, because at that time steam-powered vehicles such as ships and trains were more suitable for the range.

Delirium furiosum First train passenger 40 Years before Galton’s first isochronous map, it is said to be traveling with 30 km / h have become bad, medical councils are even said to have warned against a delirium furiosum. At the latest since Chuck’s Yeager’s flight 1881 with a Bell X-1 through the sound barrier, we can know that too higher speeds can be survived; Yeager only died 73 years after his pioneering act. The force that an electric car pushes the occupants into their seats when starting off in a sporty way has not harmed people either. What could the astronauts who were shot into space by the Saturn V say?

Today, since most of the world’s points can be reached within a few hours to days, isochronons have maps for normal people not as important as, for example, the broadband or mobile communications atlas. The one for Lower Saxony nowadays has hardly any dead spots. That was before 13 Years different when I started commuting from Bremen to Hanover by train. In order not to let the travel time pass unused, I went online with a UMTS stick on my laptop early in the morning in Bremen’s main train station, looked for topics for reports, researched and drove into a dead zone where I could write the report. If I was finished with the report, I could put it in the editorial system shortly before Verden or not, if research was still required. Then I used the reception until shortly after Verden, drove into the next radio hole and then had Internet again in the area around Nienburg. The third dead zone followed between Nienburg and Hanover.

Over the years I had become so used to the rhythm that I kept it when the ICE finally offered a continuous connection via WLAN. WLAN was already available in the ICE, but just like my UMTS stick it understood every radio gap. It only offered the opportunity to conserve my data volume if it worked. Sometimes the WiFi worked, but the router behind it wasn’t connected to the internet. When I pointed this out to the train drivers, they either asked me what I wanted, the WLAN was switched on, or they said the router had to be restarted, that would only be possible in Hanover, the destination of my morning journey.

No, reservations are no longer transferred to the displays on the seats via diskette, that has not happened for a long time, assures Deutsche Bahn. The reservation data would be on a DB server and would be received on the train via a modem or mobile phone via cellular network and then shown on the displays. But here, too, there are of course pitfalls, because it could well happen that the connection to the server can only be established after the journey has started, or not at all. Malfunctions on servers or cell phone providers could also prevent data transmission. The result: “Release if necessary.”

A jolt brought me out of my thoughts about yesterday, today and tomorrow, the bus reached Hoya and crossed the Weser. Here I had to change trains and, contrary to the written prohibition, spoke to the driver where I had to get off to get to Hassel, especially since the area had quickly become more rural again. “Oh, we’ve already passed the train station. But I’ll turn around for you and drop you off there.” He said, turned around and dropped me off a kilometer later.

(anw)