Lately, the consumer internet — that set of products devoted to building and monetizing large networks of people — has started to feel rather buzzy. A space that had been largely emptied out over the past five years is once again humming with life. The products are compelling enough, and growing fast enough, that Facebook and others have begun trying to reverse-engineer and copy them.

It still doesn’t seem quite real to me, and yet everywhere I look the signs are there: social networks are competitive again.

Today, let’s tour this weird new landscape and talk about what it means — and doesn’t mean — for the tech giants and the governments trying to rein them in.

I. How competition ended

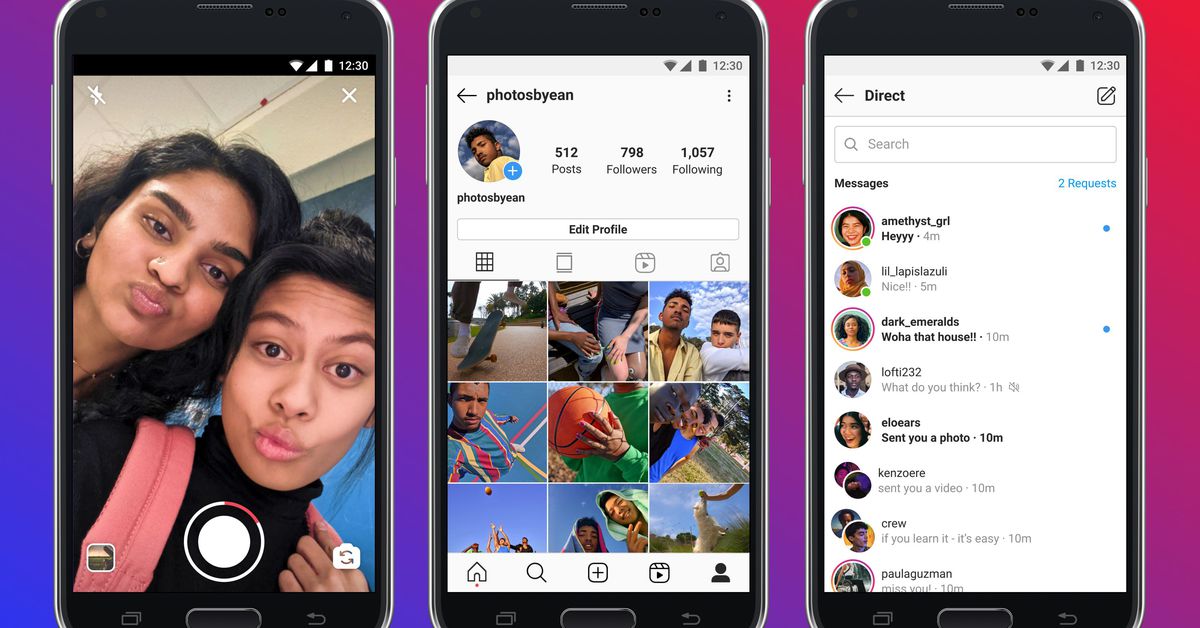

If I had to put a date on when competition ended among social networks in the United States, I’d choose August 2nd, 2016. That’s when Instagram introduced its copy of Snapchat stories, blunting the momentum of an upstart challenger and sending a chill through the startup ecosystem.

I don’t think copying features is necessarily anti-competitive — in fact, as I’ll argue below, it’s a sign that the ecosystem is working as intended — but the effect of Facebook’s copying here was dramatic. Snap fell into a long funk, and would-be entrepreneurs and investors got the message: Facebook will seek to acquire or copy any upstart social product, dramatically limiting its odds of breakout success. Investment shrunk accordingly.

The previous year, after the success of Twitter’s Periscope app, Facebook had cloned its live video features, and enthusiasm for both products seemed to broadly peter out. When live group video experienced momentary success under Houseparty, Facebook cloned that too, and Houseparty later sold to Epic Games for an undisclosed sum.

It was in this stagnant environment that many people, myself included, came to believe that it had been a mistake to let Facebook acquire Instagram and WhatsApp. The former became the breakout social network of a younger generation, and the latter cemented Facebook’s global dominance in communication. A world in which both had remained independent would have been much more competitive, even if neither had grown to the scale that they did under Facebook.

This is the basic thesis of the Federal Trade Commission’s antitrust lawsuit against the company, which it filed in December. The government argues that Facebook “is illegally maintaining its personal social networking monopoly through a years-long course of anticompetitive conduct,” and if successful, it could force Facebook to sell off Instagram and WhatsApp. It’s a tricky case; as Ben Thompson explains here, the government’s attempt to define the market in which Facebook competes so as to prove it has a monopoly is rather tortured.

You can think the FTC’s case against Facebook is weak and also believe that the period from 2016 to 2021 saw remarkably little innovation among American social networks, at least in terms of the basic user behaviors that they inspire. The market for social products became incredibly concentrated; Facebook and Google built a duopoly in digital advertising; and their vast size and unpredictable effects helped to trigger a global backlash against American tech giants.

If, like me, you think this is all a problem, you could argue for one of two basic approaches to fixing it. The first is government intervention, in the form of an antitrust lawsuit or new regulations from Congress, that would regulate the ability of tech giants to acquire smaller companies or put up new barriers to entering the market or competing on fair terms. The second is to do basically nothing, trusting that the entropic nature of the universe and the inexorable march of time would eventually restore competition.

If the second choice sounds ridiculous, it is not without precedent. In the late 1990s, Microsoft’s dominance over the PC market led the government to pursue an antitrust case over the company’s move to bundle its Internet Explorer browser with the Windows operating system. The fear was that such bundling would grant Microsoft total power over the consumer PC market forever. In reality, of course, mobile phones were out there just waiting to be perfected, and then Apple came along and did just that, and now no one really worries too much about Microsoft’s power over the PC market.

I do wish the US government had intervened around 2016 to explore new regulations for tech giants’ mergers and acquisitions. In its absence, we could only bet on entropy — and whichever contrarian capitalists still felt like they could challenge Facebook in the market despite its many advantages.

The thing is, though, that a bunch of contrarian capitalists did. And lately they have been having a lot of success.

II. How competition began

Facebook’s biggest competitor in 2021 is, of course, TikTok, which has been siphoning usage from Facebook’s family of apps since it launched in the United States in 2018 (after merging with Musical.ly).

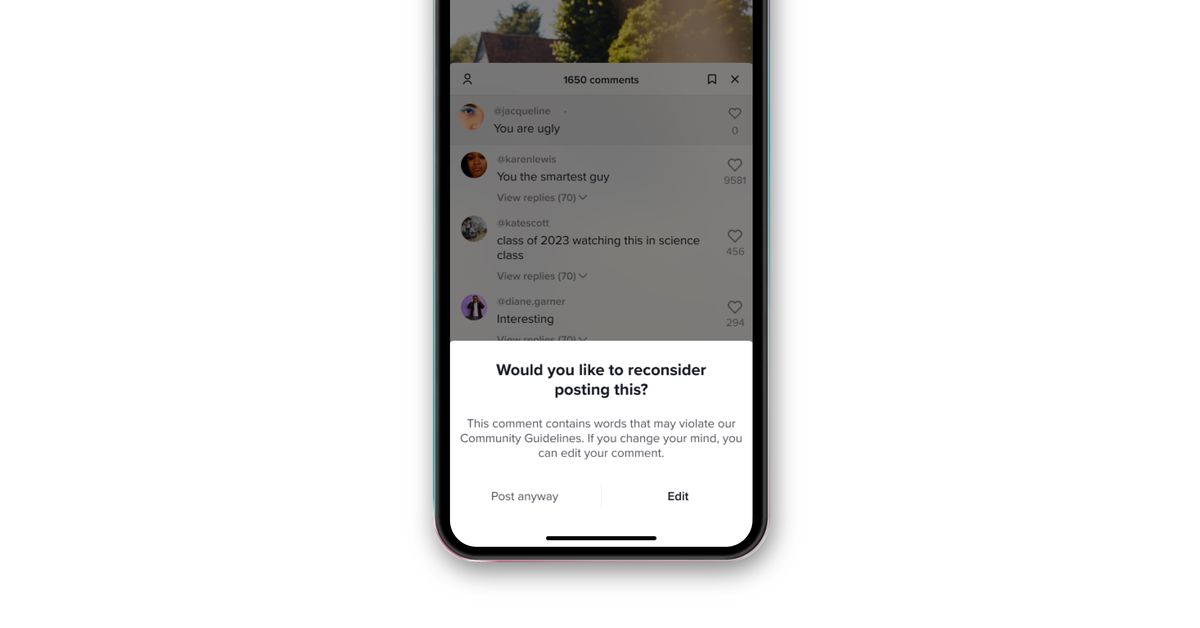

TikTok began by making it dramatically easier for people to make compelling videos, parceled out fame and fortune with a central feed that is incredibly compelling even if you don’t know or follow a single person, and eventually created an entire universe of audio memes, visual effects, and community in-jokes.

Eugene Wei, our best writer and thinker on TikTok, published the third part of his essay series about the app Sunday night. Among the many salient points Wei makes is that the sheer number of forces that have gone into TikTok’s success have made it difficult for Facebook (or YouTube) to clone. He writes:

People will litigate Instagram copying Snapchat’s Stories feature until the end of time, but the fact is that format wasn’t ever going to be some defensible moat. Ephemerality is a clever new dimension on which to vary social media, but it’s easily copiable.

This is why TikTok’s network effects of creativity matter. To clone TikTok, you can’t just copy any single feature. It’s all of that, and not just the features, but how users deploy them and how the resultant videos interact with each other on the FYP feed. It’s replicating all the feedback loops that are built into TikTok’s ecosystem, all of which are interconnected. Maybe you can copy some of the atoms, but the magic lives at the molecular level.

The success of TikTok is a source of real anxiety inside Facebook, where employees ask CEO Mark Zuckerberg a question about it during nearly every all-hands Q&A session. The company has deployed a competitor, called Reels, inside of Instagram, and perhaps it will find a way to succeed. But the larger point is that, whatever the odds, Facebook now has to compete against TiKTok or risk losing the next generation.

You’ve probably already considered that, though. (Unless you’re the FTC, which conspicuously avoided any mention of TikTok in its entire complaint about Facebook’s alleged monopoly position.) But when it comes to mobile short-form video, Facebook and YouTube face a real challenge.

So where else does Facebook suddenly find itself forced to compete?

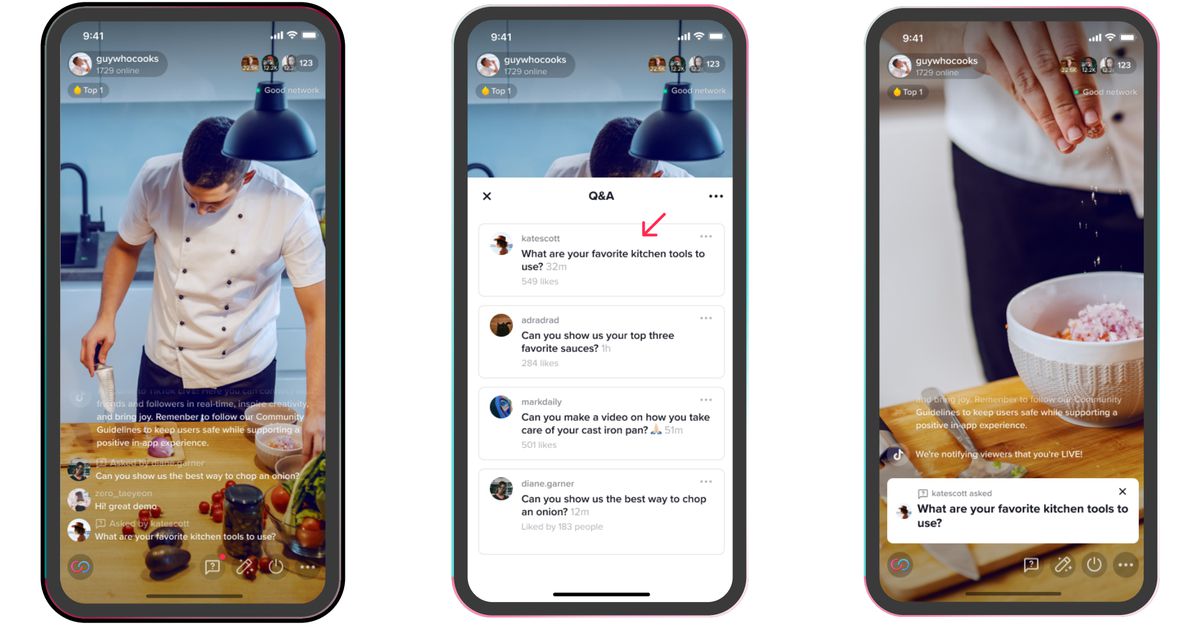

For starters, there’s audio. While still available only by invitation, Clubhouse recently hit an estimated 10 million downloads. Celebrities including Tiffany Haddish, Elon Musk, Joe Rogan, and Zuckerberg himself have made appearances on the app, granting it a cultural cachet rare in a social startup that is still less than a year old. Clubhouse raised money last month at a valuation of $1 billion — more than Facebook ultimately paid for Instagram.

Because it’s an audio app, Clubhouse doesn’t pose quite the existential threat that TikTok does: you can still theoretically browse Instagram or message businesses on WhatsApp while listening to a Clubhouse chat. But Facebook has been sufficiently intrigued by Clubhouse’s rapid rise that it is now working out how to clone the app, according to a report this month in The New York Times. Elsewhere, Twitter already has a Clubhouse clone, called Spaces, in beta. It’s not clear that Clubhouse poses a threat to either company, exactly. But both are still taking it as a challenge.

What else?

After years of making its most prominent investments in technically challenging media involving video, augmented reality, and virtual reality, Facebook is reportedly taking a second look at text. The rise of Substack over the past year has begun to mint a growing number of millionaire, text-based creators, while also pulling millions of people away from their social feeds into the relative calm of the email inbox. (I have a personal stake in this one, of course; I started a newsletter in large part because my social feeds had come to feel like a lousy place to get my news.)

What’s interesting here is that Facebook now seems open to this possibility, too. Last month, the Times also reported that Facebook is developing newsletter tools for reporters and writers. (I’ve confirmed this with my own sources.) As with Clubhouse, newsletters hardly pose an existential threat to Facebook. But they do bleed time and attention away from the company’s apps — and in a world where news may not be even available on Facebook in some countries, it may be wise for it to have a hedge. (And Twitter clearly thinks so, too: it acquired Substack competitor Revue last month.)

That leaves Facebook competing with legitimately fast-growing, well-funded competitors across several categories. And while it’s in a much earlier stage, I think the company may soon have an interesting competitor in photography as well.

Dispo is an invite-only social photo app with a twist: you can’t see any photos you take with the app until 24 hours after you take them. (The app sends you a push notification to open them every day at 9AM local time: among other things, a nice hack to boost daily usage.) Founded by David Dobrik, one of the world’s most popular YouTubers, Dispo has been around as a basic utility for a year. But last month a beta version launched on iOS with social features including shared photo “rolls,” and it quickly hit the 10,000-person cap on Apple’s TestFlight software. It raised $4 million in seed funding in October, and assuming the buzz continues into a public launch, I wouldn’t be surprised if Dispo took off in a major way.

Audio, video, photos, and text: to some extent, Facebook has never had to stop competing across these dimensions in the company’s history. But I can’t remember the last time it was fighting so many interesting battles at the same time.

III. What it means

Here’s what I’m not saying when I argue that social networks are competitive again:

- That Facebook has not acted in various anti-competitive ways throughout its history.

- That Facebook should no longer be subject to antitrust scrutiny, or that the US government (and, separately, a coalition of US attorneys general) should abandon their lawsuits.

- That, given all this new competition, Facebook should be allowed to purchase rival social networks in the future.

- That Facebook won’t remain the world’s largest social network for a long time to come, or that its business will suffer in the short term.

In fact, I think there’s a good case to be made that antitrust pressure from the US government in particular is what has allowed competition to return to social networks in the first place. Had Clubhouse or Substack emerged in 2013 or 2014, it’s not hard to imagine Facebook racing to acquire them and knock them off the chessboard. But in 2021, when Facebook faces a formal antitrust review in the United Kingdom over its acquisition of a failing GIF search engine, the company can only sit back and try to copy what others are doing better.

If that’s the case, it suggests that the half-assed response to Facebook’s growing dominance over the past half-decade nonetheless got us, however belatedly, to a better place. Antitrust pressure made it extremely difficult for the company to make acquisitions, opening a window just big enough for new entrants to climb through. It remains to be seen how big any new challengers to Facebook, YouTube, or Twitter can grow. But for the first time in a long time, I’m optimistic about their chances.